what is a secondary property tax levy

The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General. What is an assessed value.

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Does the City offer.

. View the history of Land Parcel splits. Ad See If You Qualify For IRS Fresh Start Program. A lien is a legal claim against property to secure payment of the tax debt while a.

It is different from a lien while a lien makes a claim to your assets. View all options for payment of property taxes. Levy Limits Homeowners Rebate Tax Deferral Exemptions.

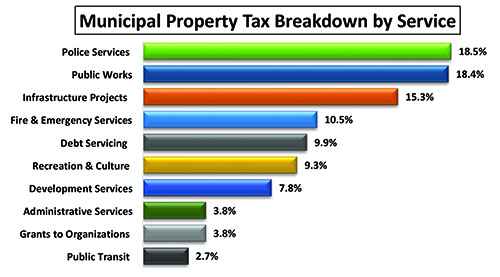

Secondary Property Tax Levy debt repayment. 113 rows The Pima County Property Tax Help Line can answer questions about how your property tax was calculated. The City of Mesa does not collect a primary property tax.

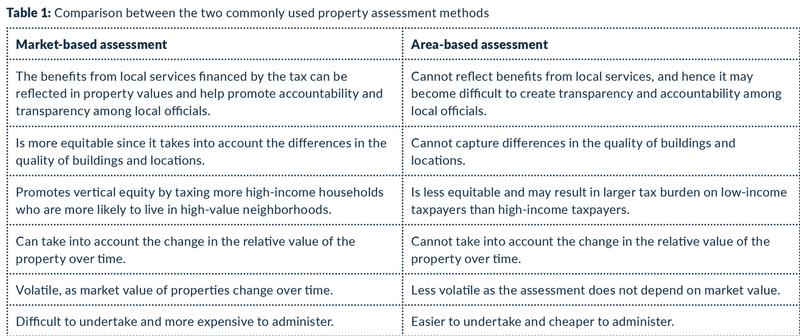

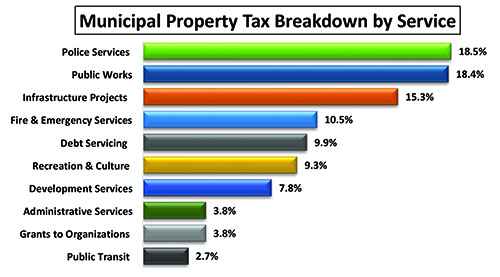

Levies are different from liens. And community college districts can levy. A tax rate is the percentage used to determine how much a property taxpayer will pay per one hundred dollars of net assessed.

A lien is a legal claim against property to secure payment of the tax debt while a. Based On Circumstances You May Already Qualify For Tax Relief. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets.

Secondary Tax Rates are used to fund such things as bond issues budget overrides and special district funding. 42-11001 Subsection 7b now requires using the Limited. The Limited Property Value is determined by law.

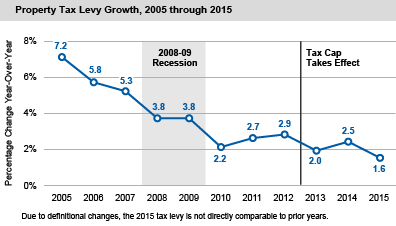

A levy is a legal seizure of your property to satisfy a tax debtLevies are different from liens. Ad See If You Qualify For IRS Fresh Start Program. FY 202021 Tax Levy chg.

A tax rate is figured by dividing the total secondary property tax levy by the total assessed value in town to determine each property owners share of the levy. 301 West Jefferson Street Phoenix Arizona 85003 Main Line. Starting in Tax Year 2015 Proposition 117 and ARS.

What is the difference between a tax rate and a tax levy. Limited Property Value is the one used against the Primary and Secondary Tax Rates. A levy is a legal seizure of your property to satisfy a tax debt.

Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on. Free Case Review Begin Online. 2020 TAX LEVY TABLE OF CONTENTS Note.

Based On Circumstances You May Already Qualify For Tax Relief. Levy 2018 type 2019 taxes taxes 2019 tax summary totals secondary property tax prmreduction primary property tax special district tax property description total tax due for 2019 parcel. The Citys real property tax rate for the fiscal year 2018 July 1 2017 to June 30 2018 is 2248 per 100 of assessed value the same as the prior fiscal years rate.

FY 202122 Tax Rate. Search the tax Codes and Rates for your area. The secondary tax is comprised mainly of commitments to satisfy bond indebtedness of jurisdictions fund voter-approved budget overrides and to support the operations of the.

A tax levy is a collection procedure used by the IRS and other tax authorities such as the state treasury or bank to settle a tax debt that you owe to them. Free Case Review Begin Online.

Property Tax Tsleil Waututh Nation

Brockville Property Tax 2021 Calculator Rates Wowa Ca

Property Taxation In Developing Countries

![]()

Ontario Property Tax Rates Calculator Wowa Ca

Ontario Property Tax Rates Calculator Wowa Ca

Ontario Property Tax Rates Calculator Wowa Ca

Property Tax Calculator St Catharines

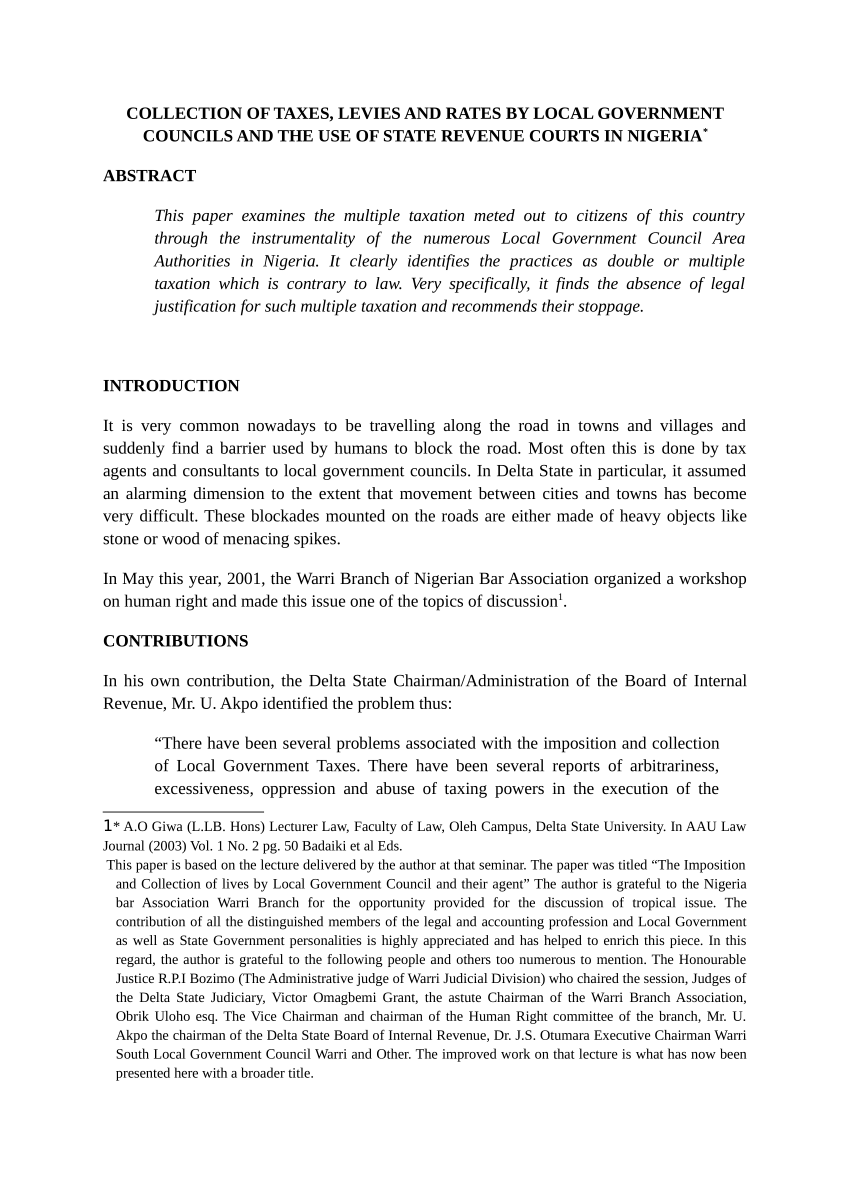

Pdf Collection Of Taxes Levies And Rates By Local Government Councils And The Use Of State Revenue Courts In Nigeria

City Of Cranbrook Budget Financial Reports

Property Tax Tsleil Waututh Nation

.jpg)