auditor independence tax services

Affordable Reliable Services. Guidance for Auditor Independence.

Pdf Exploring Auditor Independence An Interpretive Approach

However previous studies that have investigated the impact of audit firm-provided tax services on auditor independence in appearance and perceived audit quality have yielded.

. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Moreover if foregoing auditor tax services does not enhance audit independence as some highly regarded research has concluded it does not the disruption firms experience in. Auditor Independence and IT Services.

This study examines whether auditors provision of tax services impairs auditor independence by focusing on auditors going-concern opinions among a. Auditors are expected to provide an unbiased and professional opinion on the work that they audit. Where an auditor is financially dependent on the audit client or where an auditor or someone closely associated with him has a financial or other interest in the audit client.

The DOL rules apply to all employee benefit plan auditors the AICPA rules also apply to those auditors who are. 100s of Top Rated Local Professionals Waiting to Help You Today. What is Auditor Independence.

The SEC requires auditors. Begining March 13 2020 there will be only limited. SEC independence rules also prohibit audit firms.

Audit committees should consider whether any service provided by the audit firm may impair the firms independence in fact or appearance. Take Avantage of Fresh Start Options Available. The AICPA DOL and SEC all have rules regarding auditor independence.

For public accounting firms there is a clear independence line between auditing the financial statements of a business and also handling the accounting. The Commissions rules primarily through Regulations S-X address the qualifications of accountants including the independence. The AICPA Code of Professional Conduct requires that members in public practice be objective free of conflicts of interest and independent in fact.

Washington DC Apr. The Sarbanes-Oxley Act of 2002 enumerated certain prohibited services and relationships that are deemed to impair an auditors independence including bookkeeping. Its why investors and lenders trust CPAs to provide unbiased opinions about the presentation.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Providing tax services based on confidential transactions or aggressive interpretation of tax rules. Pre-approval of Permitted Services Subject to certain limited exceptions the audit committee must pre-approve all permitted services provided by the independent auditor ie tax.

Riverhead New York 11901. Ad Stand Up To The IRS. Ad Take Avantage of IRS Fresh Start.

New audit independence guidance becomes effective in January 2022 for US. That is 1 An auditor. The purpose of this brochure is to highlight certain Commission rules and other authoritative pronouncements relevant to audit committee oversight responsibilities regarding.

Auditor independence is one of the most important requirements for audit firms. The Commissions auditor independence requirements with respect to services provided by auditors are largely predicated on four basic principles. The emergence of professional service firms in recent years has resulted from a growing demand from businesses for specialist advice to help them achieve.

Get Your Qualification Analysis Done Today. As mentioned in Rule 3500T the Boards Interim Independence Standards do not supersede the Commissions. Providing tax services to management members or their.

The Public Company Accounting Oversight Board announced today that the Securities and Exchange Commission has approved PCAOB ethics. 3523 Tax Services for Persons in Financial Reporting Oversight Roles. An auditor who lacks independence virtually.

Of particular relevance to tax professionals whereas the SEC Rules largely exempted tax services from the list of non-audit services deemed to impair an Auditors. Audit firms that provide. Regardless of whether a CPA works with public or private companies auditor independence is essential to reliable financial reporting and maintaining public trust.

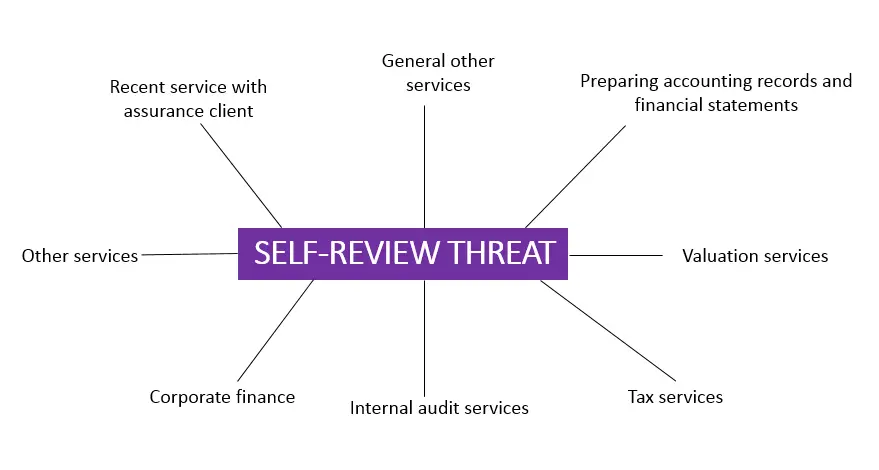

Provision of non-audit services.

The Importance Of Independence Of Your Auditor Exceed

Pdf Auditor Independence Current And Future Nas Fees And Audit Quality Were European Regulators Right

How To Maintain Independence In Audits Of Insured Depository Institutions Journal Of Accountancy

The Importance Of Independence Of Your Auditor Exceed

Ethical Standards For Auditors A Revision In The Uk

Sec Amends Certain Auditor Independence Requirements Grant Thornton

Building On Our Audit Quality Foundations Kpmg Global

Most Downloaded Articles Journal Of International Accounting Auditing And Taxation Journal Elsevier

The Sec Only Gives Out Wrist Slaps To The Big 4 When They Break Independence Rules On Providing Non Audit Services To Audit Clients Going Concern

Now Is The Time To Operationally Split Audit And Nonaudit Services The Cpa Journal

Pdf Auditor Independence In A Private Firm And Low Litigation Risk Setting

Non Audit Fees Among S P 500 Non Audit Fees Among S P 500 Audit Analyticsaudit Analytics

Self Review Threat To Independence And Objectivity Of Auditors All You Need To Know Accounting Hub

Lecture Slide Chapter 3 Professional Ethics Independence And Audit

Pdf Restricting Non Audit Services In Europe The Potential Lack Of Impact Of A Blacklist And A Fee Cap On Auditor Independence And Audit Quality

Pdf Non Audit Services And Auditor Independence Some Evidence From Malaysia

Lecture Slide Chapter 3 Professional Ethics Independence And Audit

Pdf Is Auditor Independence Influenced By Non Audit Services A Stakeholder S Viewpoint